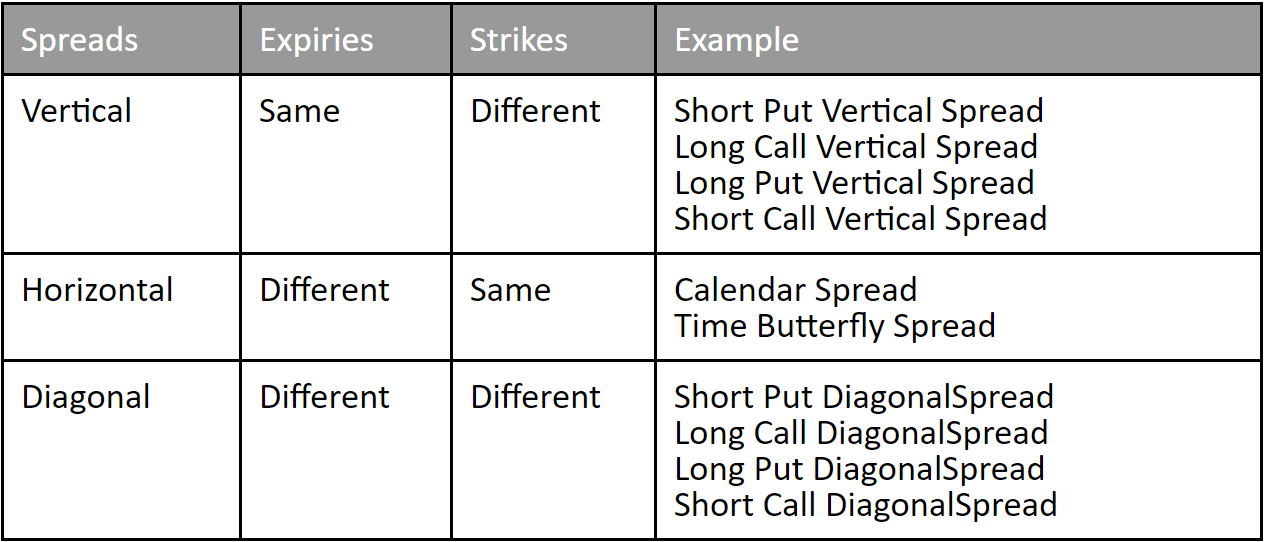

Diagonal Calendar Spread - A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

Diagonal Spreads Unofficed

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

Calendar Spread & Diagonal Spread Strategy, Pros & Cons, Real Examples

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

Option Basics Strategy Ultimate Guide to Calendar & Diagonal

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

DOUBLE DIAGONAL CALENDAR SPREAD STRATEGY TRADING PLUS YouTube

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

DIAGONAL WEEKLY CALENDAR WITH ADJUSTMENTS WEEKLY CALENDAR SPREAD

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

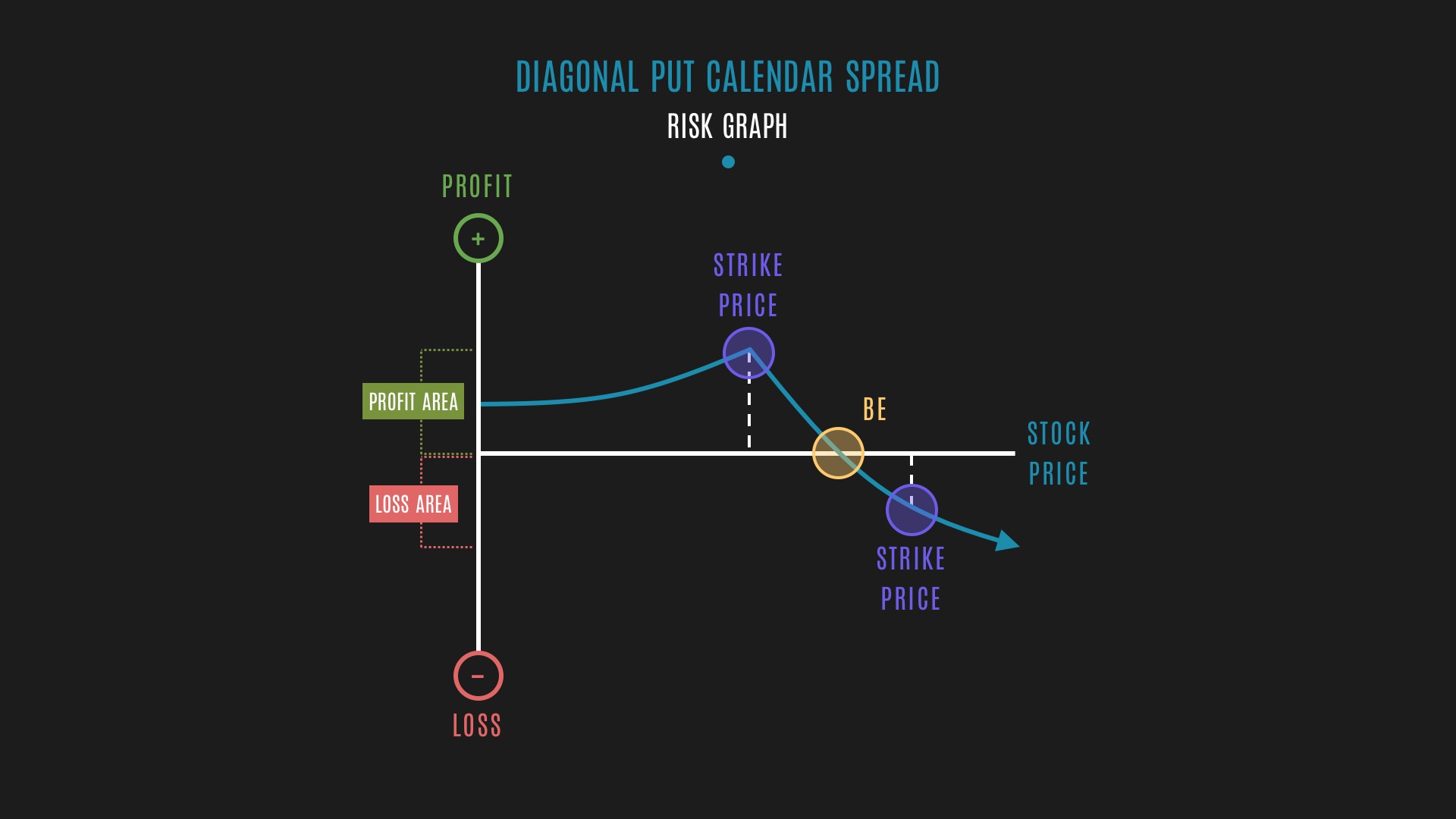

Glossary Diagonal Put Calendar Spread example Tackle Trading

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

Trading Calendar and Diagonal Spreads l Options Trading YouTube

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

Diagonal Calendar Spread Option Strategy Printable Word Searches

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

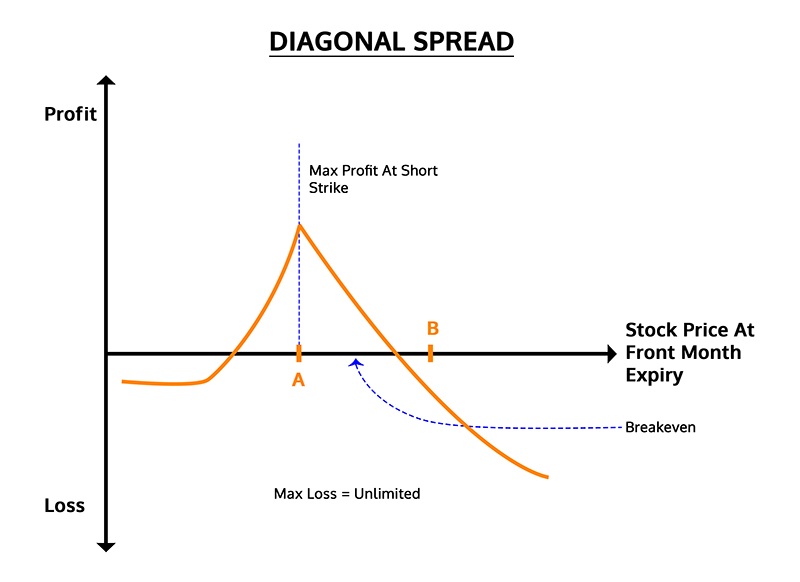

Diagonal Spread Options Trading Strategy In Python

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

The Ultimate Guide to Options Trading Strategies IMS Proschool

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

A Diagonal Spread, Also Called A Calendar Spread, Involves Holding An Options Position With Different Expiration Dates But The Same Strike Price.

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.