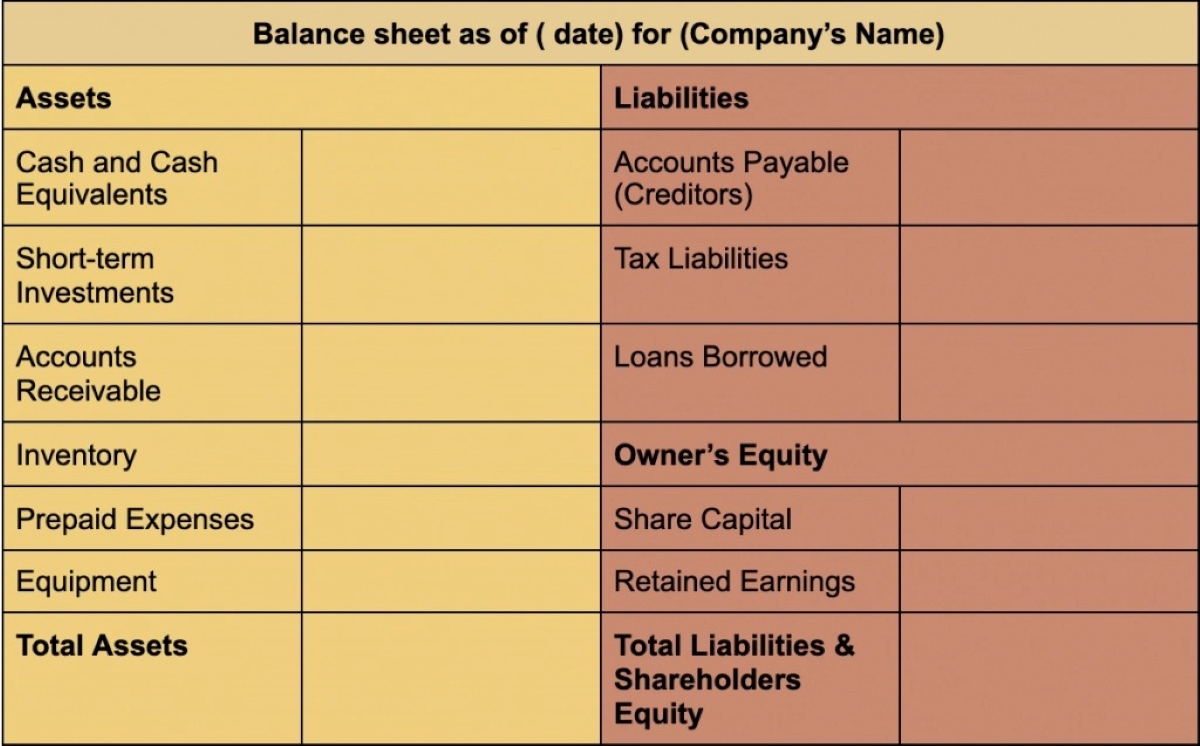

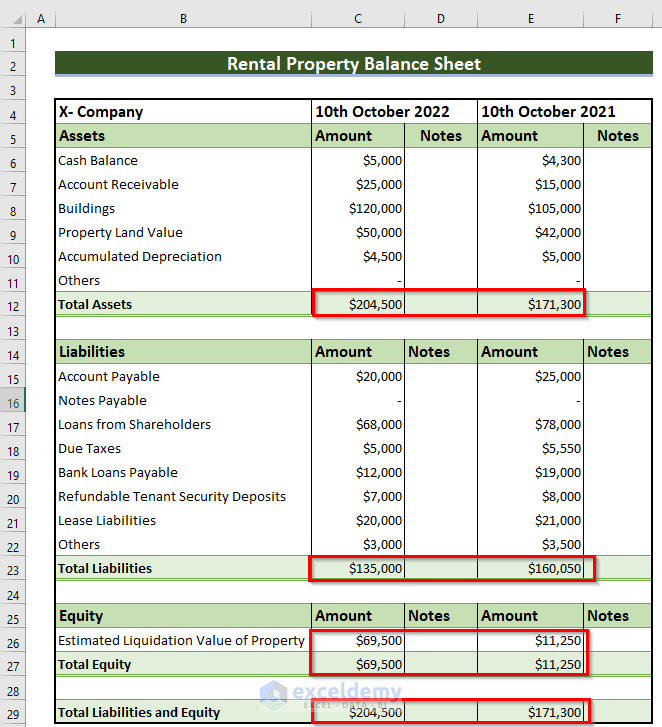

Does Prepaid Rent Go On The Balance Sheet - Other current asset types include. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. What it does simply trades one asset. From a financial reporting perspective, prepaid rent affects both the balance sheet and the income statement. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet.

What it does simply trades one asset. From a financial reporting perspective, prepaid rent affects both the balance sheet and the income statement. As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. Other current asset types include.

Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. From a financial reporting perspective, prepaid rent affects both the balance sheet and the income statement. As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Other current asset types include. What it does simply trades one asset.

Where Is Prepaid Rent On The Balance Sheet LiveWell

Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will.

[Solved] accounting. The balance in the Prepaid Rent account before

From a financial reporting perspective, prepaid rent affects both the balance sheet and the income statement. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. Other current asset types include. What it does simply trades one asset. As mentioned earlier, prepaid expenses are mentioned on the.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. What it does simply trades one asset. As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies.

Prepaid Expenses Appear Where On The Balance Sheet LiveWell

As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. What it does simply trades one asset. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance.

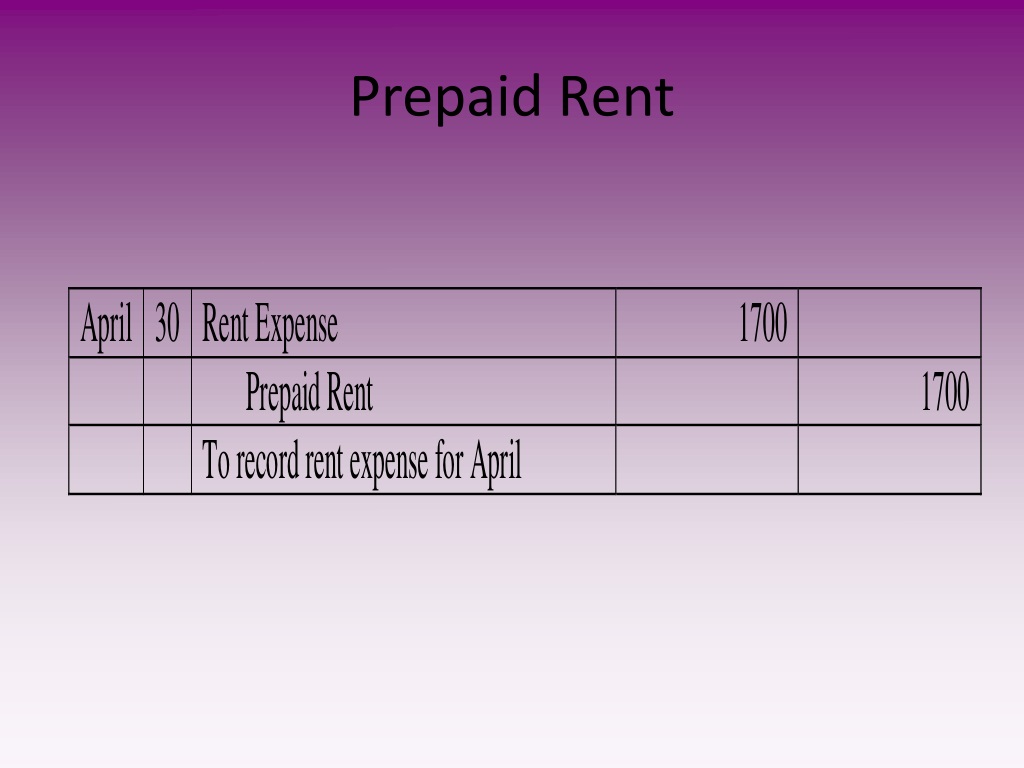

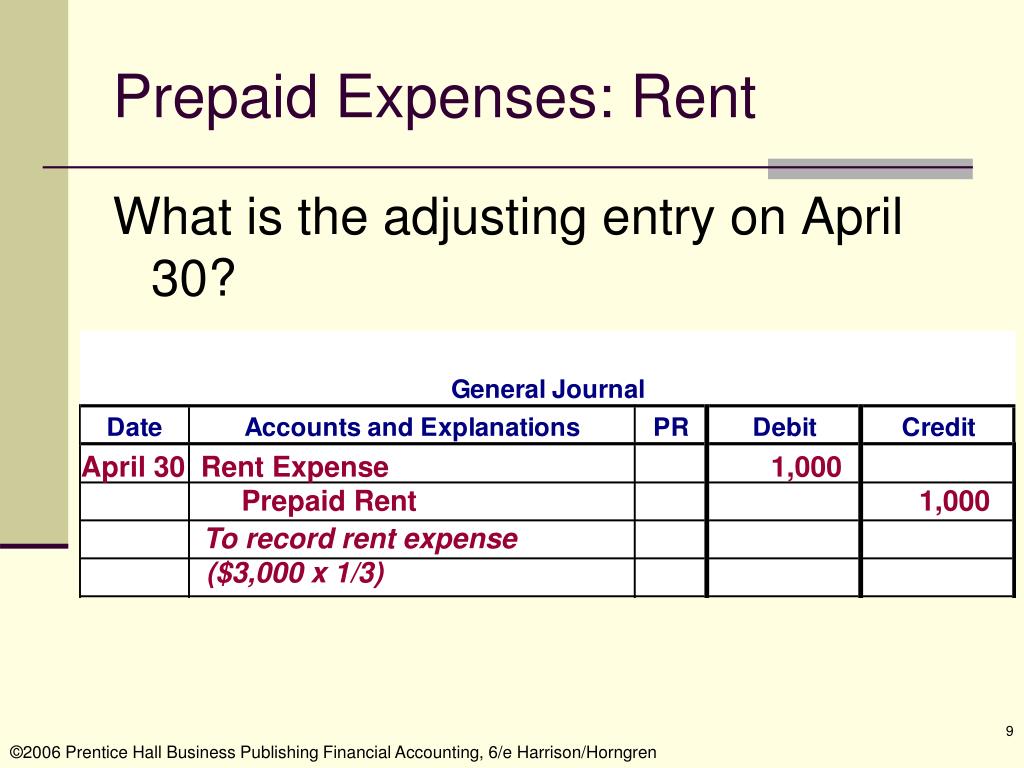

PPT Understanding Adjustments and Prepaid Expenses in Accounting

Other current asset types include. What it does simply trades one asset. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. From a financial reporting perspective, prepaid rent affects both the balance sheet and the income statement. Likewise, as an advance payment, prepaid rent doesn’t.

PPT Accrual Accounting and the Financial Statements Chapter 3

As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. What it does simply trades one asset. From a financial reporting perspective, prepaid rent affects both the balance sheet and the income.

bucketsery Blog

As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. Other current asset types include. What it does simply trades one asset. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. From a financial reporting perspective, prepaid rent affects both.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What it does simply trades one asset. As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. From a financial reporting perspective, prepaid rent affects both the balance sheet and the income statement. Instead, prepaid rent is recorded on.

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Other current asset types include. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. From a financial reporting perspective, prepaid rent affects.

What type of account is prepaid rent? Financial

Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. From a financial reporting perspective, prepaid rent affects both the balance sheet and the income statement. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. As mentioned earlier, prepaid.

As Mentioned Earlier, Prepaid Expenses Are Mentioned On The Balance Sheet As A Current Asset.

From a financial reporting perspective, prepaid rent affects both the balance sheet and the income statement. Instead, prepaid rent is recorded on the balance sheet as an asset because it signifies a service that the company will receive in the. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. What it does simply trades one asset.

Likewise, As An Advance Payment, Prepaid Rent Doesn’t Affect The Total Assets On The Balance Sheet.

Other current asset types include.