Liability On A Balance Sheet - To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. This is a list of. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of what the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. T he assets and liabilities are separated into two. A liability is an obligation between one party and another not yet completed or paid for in full. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

This is a list of. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. A liability is an obligation between one party and another not yet completed or paid for in full. This is a list of what the company. T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity.

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. This is a list of. T he assets and liabilities are separated into two. A liability is an obligation between one party and another not yet completed or paid for in full. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of what the company.

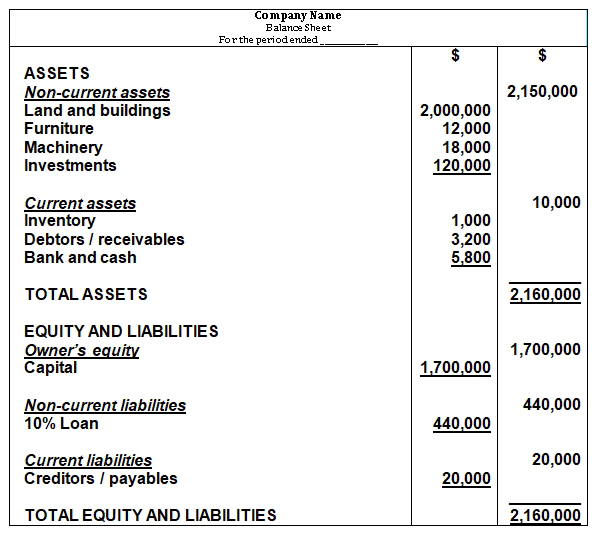

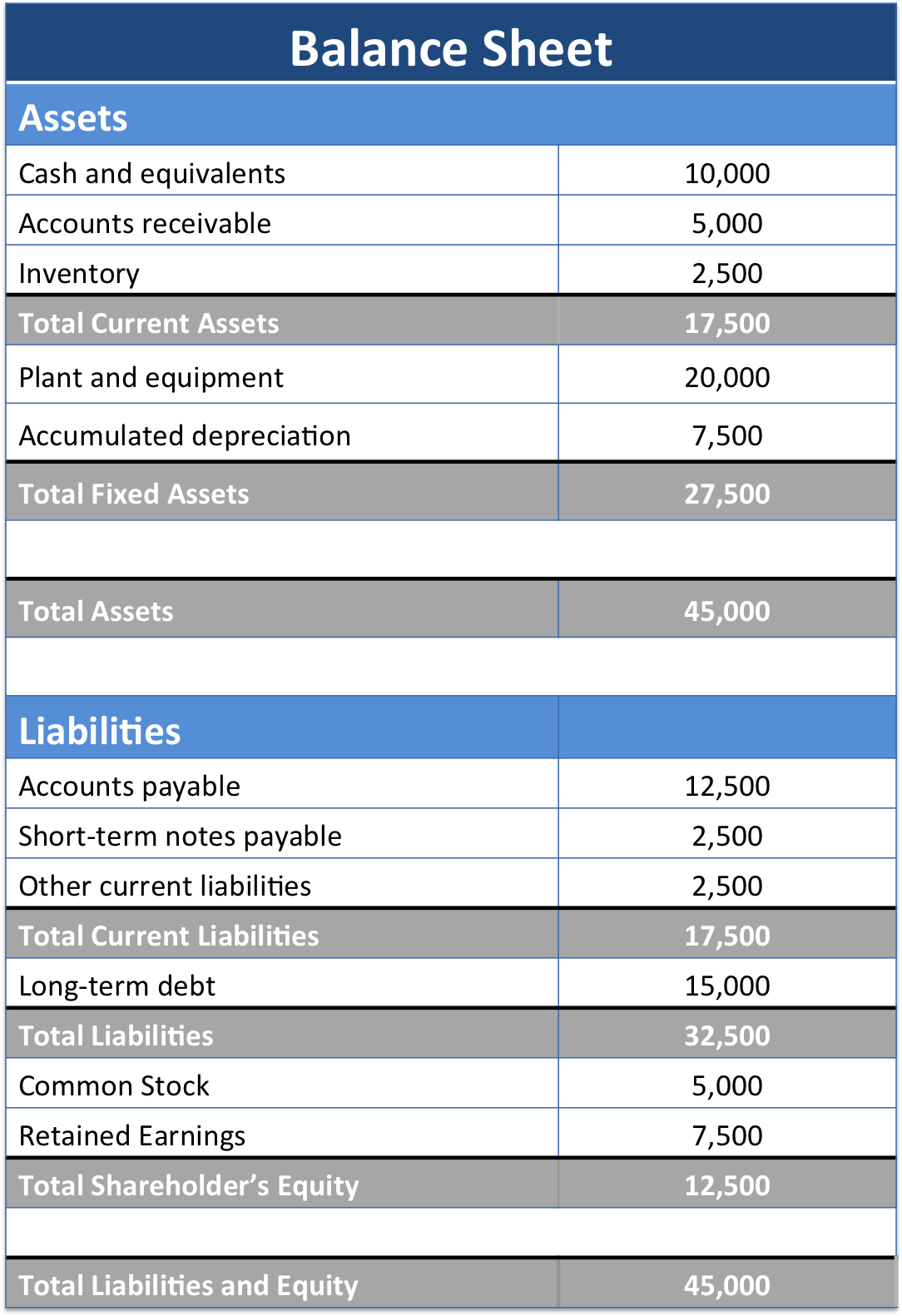

Assets And Liabilities Balance Sheet

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. This is a list of what the company. This is a list of. A liability is an obligation between one party and another not yet completed.

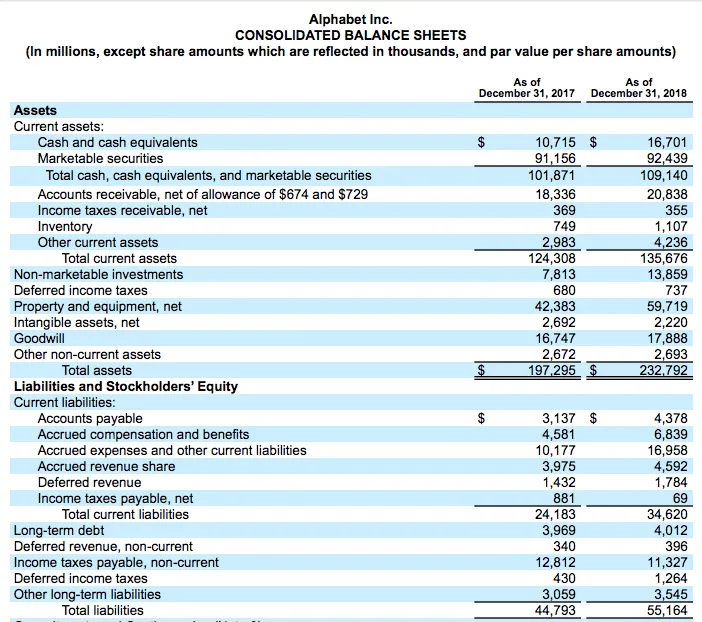

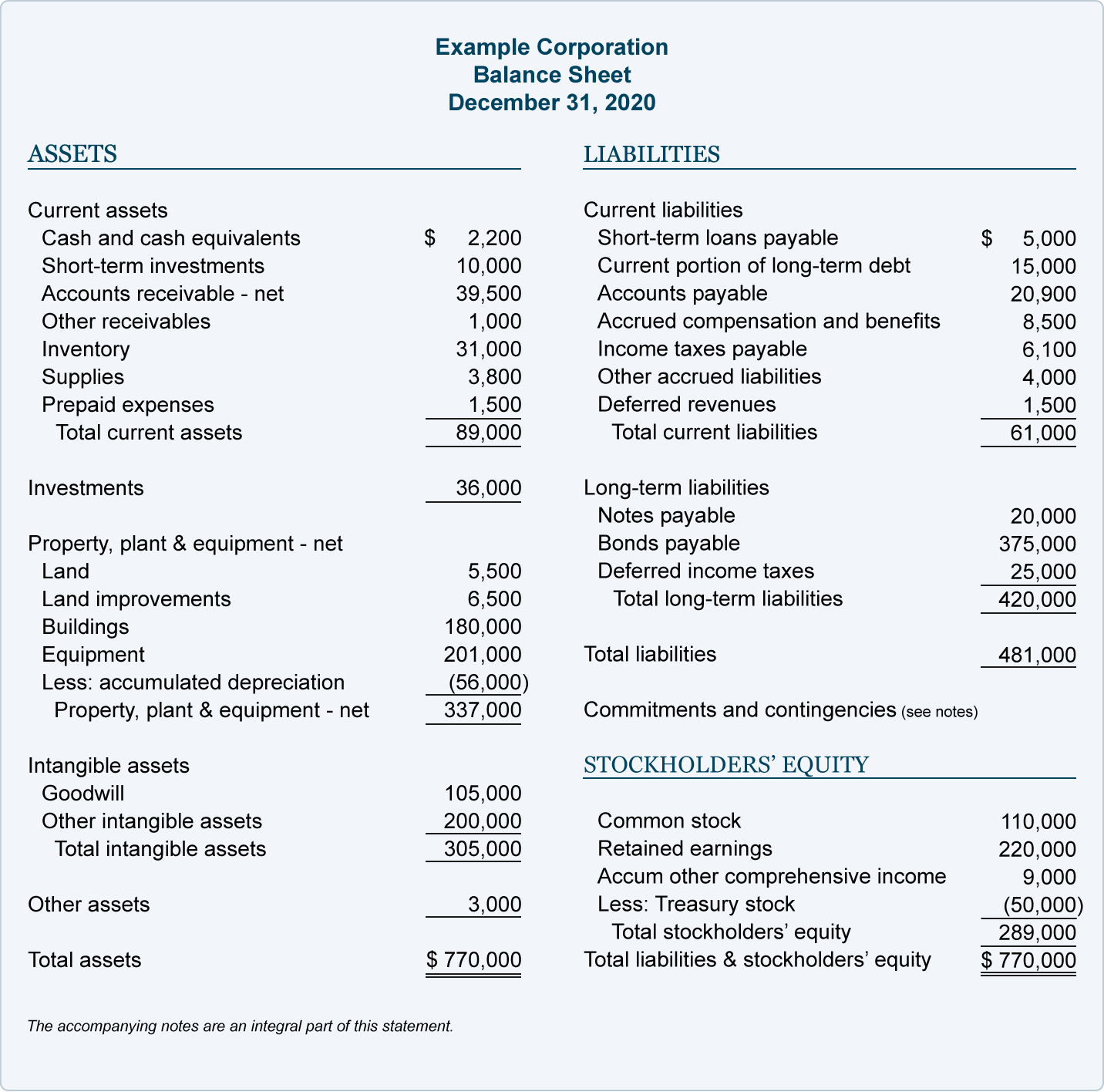

Best Warranty Liabilities On Balance Sheet And Statement Example

To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. T he assets and liabilities are separated into two. A liability is an obligation between one party and another not yet completed or paid for in full. This is a list of. On the right side, the balance sheet.

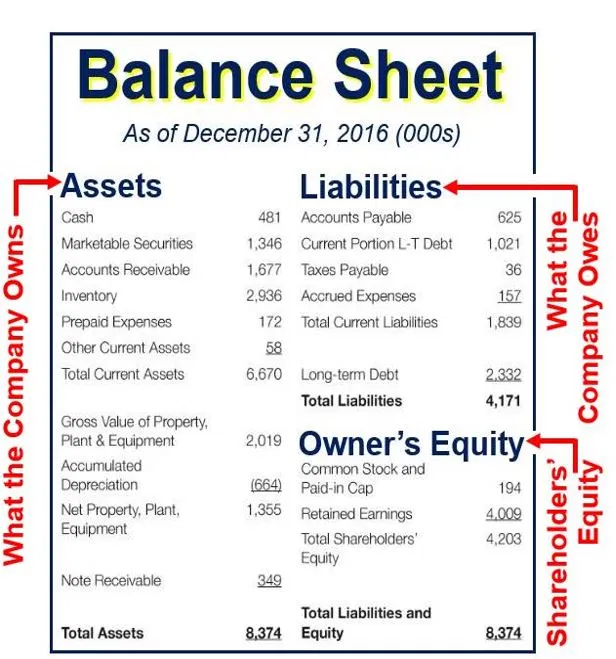

Balance Sheet Explained Structure, Assets, Liabilities with Examples

A liability is an obligation between one party and another not yet completed or paid for in full. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of. T he assets and liabilities are separated into two. This is a list of what the company.

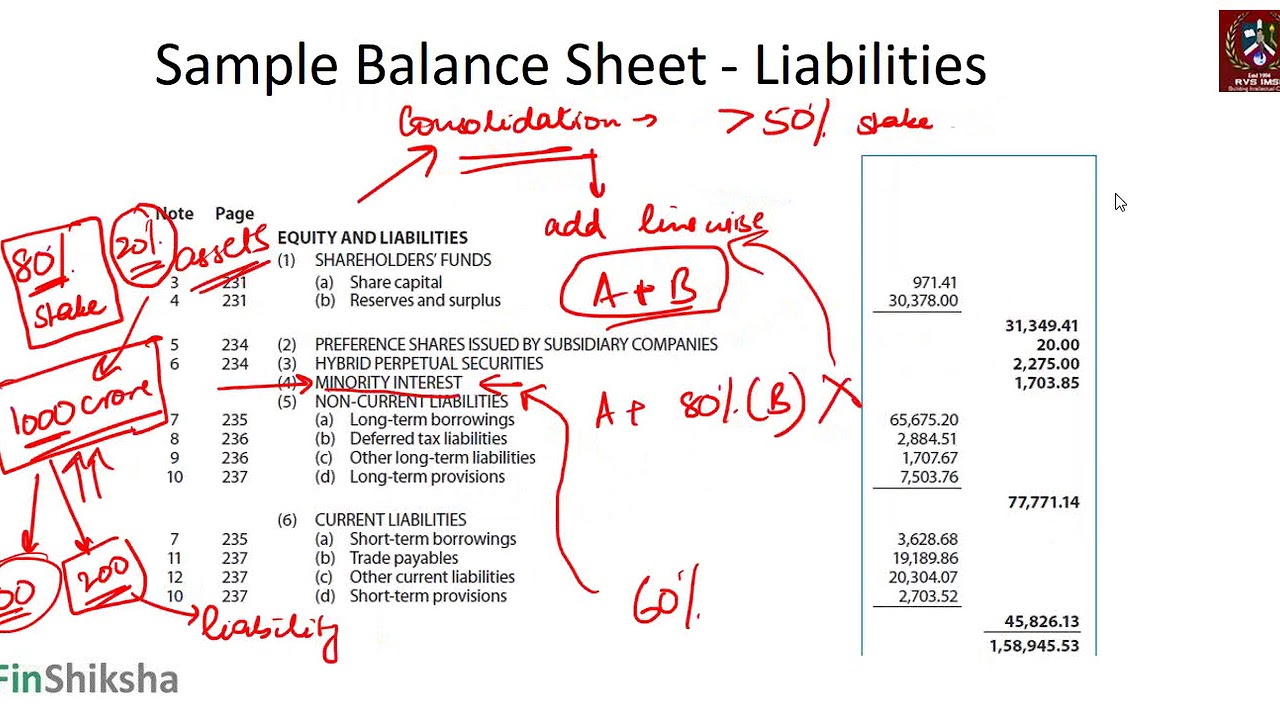

Balance Sheet Current and Noncurrent Liabilities YouTube

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of. To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. Liabilities and equity make up the right side of the balance sheet and cover.

Company Balance Liabilities Financial Statements Excel Template And

To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. This is a list of. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. T he assets and liabilities are separated into two. Liabilities and equity make up.

How to Read a Balance Sheet (Free Download) Poindexter Blog

A liability is an obligation between one party and another not yet completed or paid for in full. T he assets and liabilities are separated into two. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of what the company. Liabilities and equity make up.

Best Warranty Liabilities On Balance Sheet And Statement Example

To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. This is a list of what the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. T he assets and liabilities are separated into two. Liabilities and equity make up the right side.

Liabilities Side of Balance Sheet

This is a list of what the company. This is a list of. A liability is an obligation between one party and another not yet completed or paid for in full. To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. Liabilities and equity make up the right side.

Current Liabilities List

To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. A liability is an obligation between one party and another not yet completed or paid for in full. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities and equity make up the right.

Balance sheet example track assets and liabilities

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. A liability is an obligation between one party and another not yet completed or paid for in full. This is a list of what the company..

This Is A List Of.

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

This Is A List Of What The Company.

T he assets and liabilities are separated into two. A liability is an obligation between one party and another not yet completed or paid for in full.

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)