What Are The Current Liabilities On A Balance Sheet - The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a.

Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year.

Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year.

What are Current Liabilities? Definition and Example QuickBooks

Current liabilities are financial obligations of a business entity that are due and payable within a year. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a.

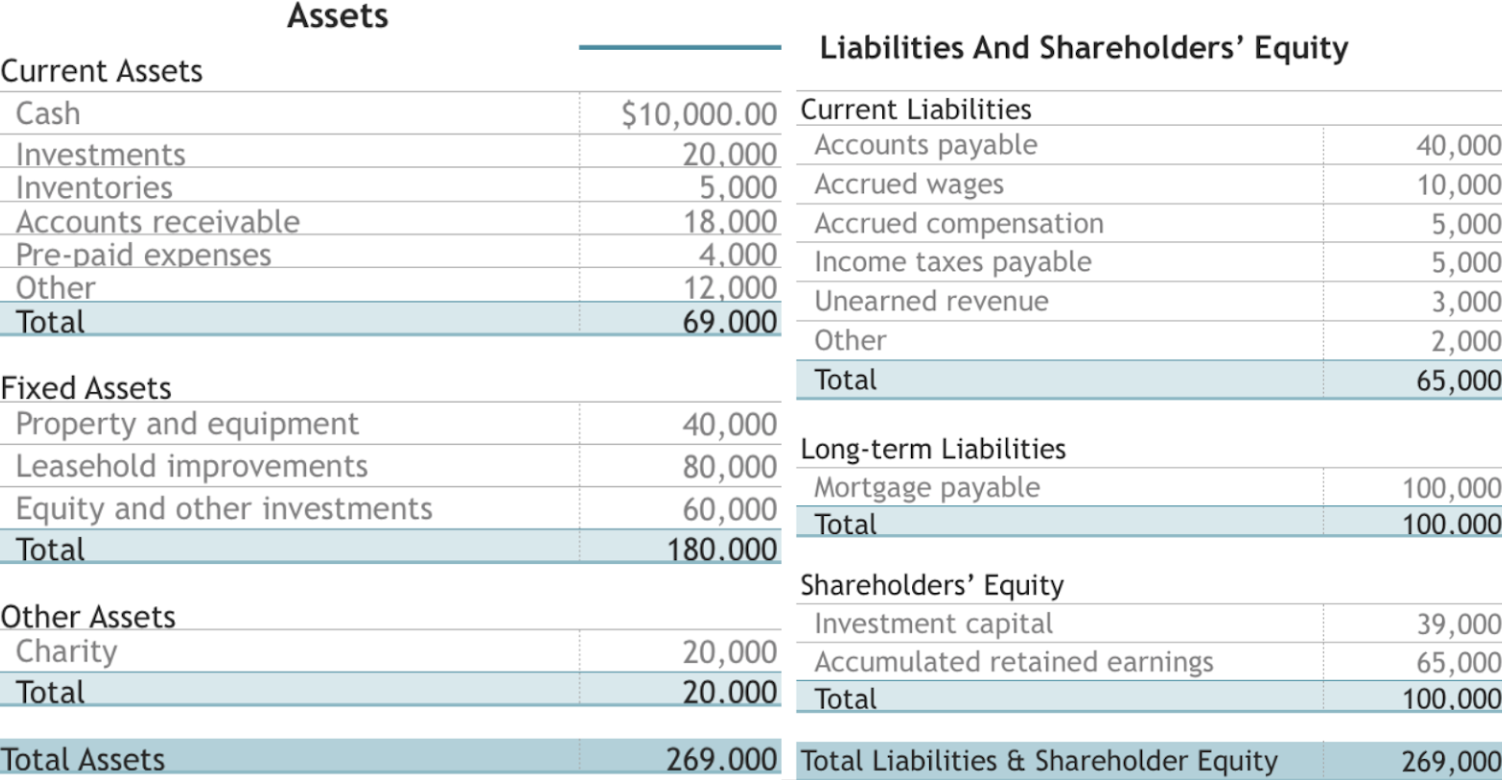

Company Balance Liabilities Financial Statements Excel Template And

Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year.

How to Read & Prepare a Balance Sheet QuickBooks

Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Current liabilities are financial obligations of a business entity that are due and payable within a year.

How to Read a Balance Sheet (Free Download) Poindexter Blog

Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. Current liabilities are financial obligations of a business entity that are due and payable within a year. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year.

Accounting 101 Liabilities The Daily CPA

Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Current liabilities are financial obligations of a business entity that are due and payable within a year.

Liabilities How to classify, Track and calculate liabilities?

Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Current liabilities are financial obligations of a business entity that are due and payable within a year.

What Is a Balance Sheet? (+Examples and Free Template)

Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. Current liabilities are financial obligations of a business entity that are due and payable within a year. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year.

Understanding Liabilities Reading a Balance Sheet

Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year.

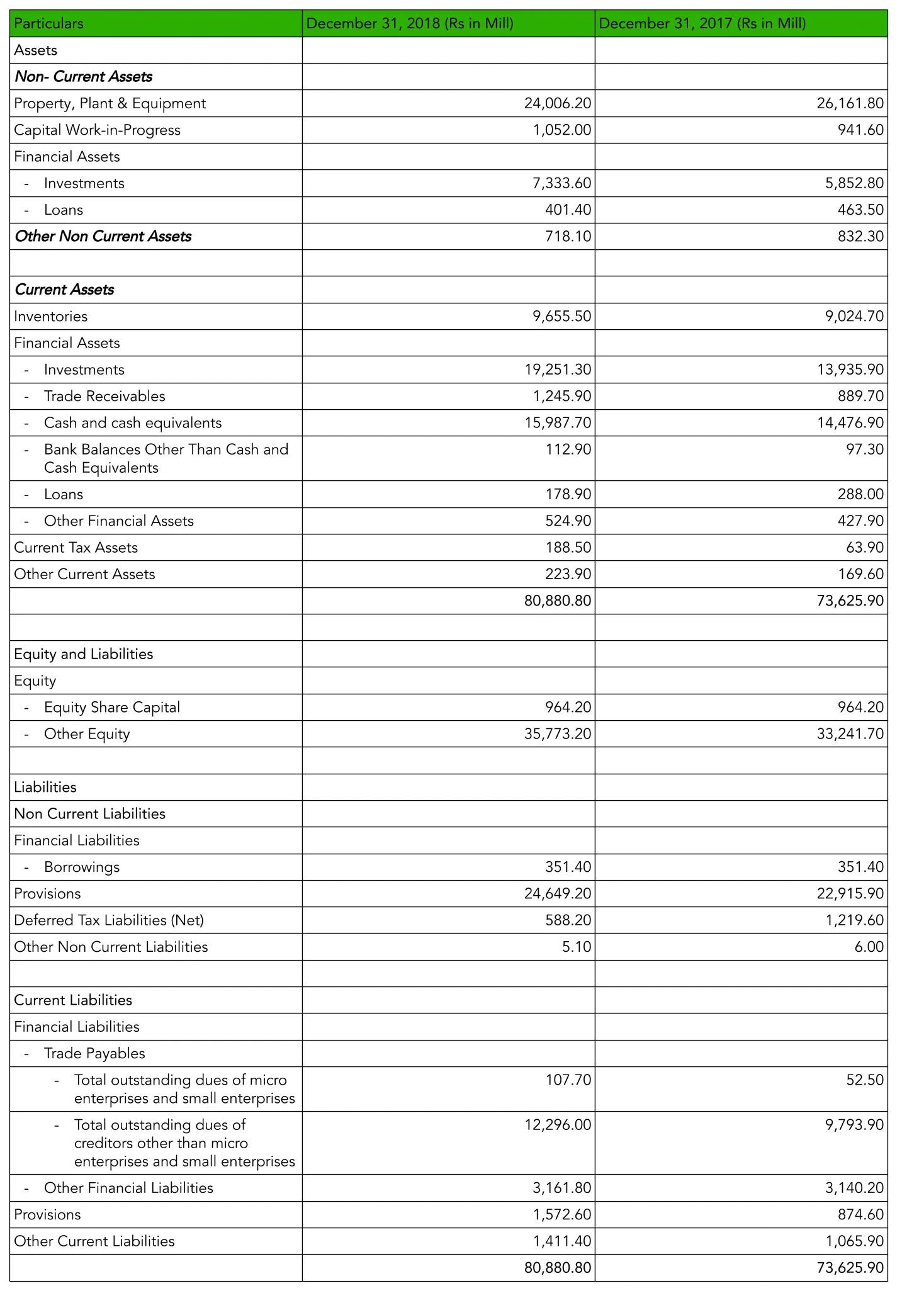

Liabilities Side of Balance Sheet

Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Current liabilities are financial obligations of a business entity that are due and payable within a year.

A Guide To Current Liabilities On The Balance Sheet

The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a.

The Current Liabilities Section Of A Balance Sheet Shows The Debts A Company Owes That Must Be Paid Within One Year.

Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a.